The Best Kept Secret in Local Government Budgeting

Fuel Budgeting Program

The fiduciary responsibility for tax dollars is central to your mission as a unit of government. When it comes to predicting budget expenses, that task may feel overwhelming. We live in a world of volatile events, where even the smallest occurrence on the other side of the world can impact Indiana. Particularly with the fuel needed to run key vehicles. With risks everywhere that are out of your control, where can you turn? Thankfully, the Indiana Bond Bank (IBB) has a tool specifically designed to protect your fuel budget against volatile prices. In these times of uncertainty, protecting your fuel budget is more important than ever. Why set your budget up for a headache when you can set it and forget it?

Benefits

What makes us different

The process

- You reach out to the Indiana Bond Bank to talk about your fuel budgeting needs.

- You request an application and a list of financial documents required for submission.

- The Indiana Bond Bank will send you all the legal documents needed for local approvals..

- The Indiana Bond Bank will monitor the market and select the hedge structure best for that particular year.

- As the closing date approaches, the Indiana Bond Bank will request your authorization to close on the hedge within certain pricing parameters.

- The Indiana Bond Bank closes on hedge transaction and notifies you of protection start date and final parameter numbers.

About

Common Questions

We have answers! If not covered here, please reach out.

If I participate in the Indiana Bond Bank’s (IBB) Fuel Budgeting Program (the “Fuel Program”), where would I purchase my fuel?

There is no change to how you purchase fuel. The Fuel Program is a financial instrument only. You may purchase and pay for fuel from any vendor.

What are the advantages of using IBB’s Fuel Program?

The Fuel Program acts like insurance for your fuel budget. It is designed to protect your budget from rising fuel prices, and provides flexibility in setting this protection. Additionally, the IBB is transparent in the costs of its program. Other fuel providers (i.e. jobbers) may charge hidden costs when they fix fuel prices.

Will the IBB audit your fuel consumption?

No, the IBB does not need your actual receipts of the fuel your consumed.

Stay up to date important updates and announcements on the program.

services

Other areas we can halp

READI Match Financing Program

Has your community received a financial commitment from the Regional Economic Acceleration and Development Initiative (READI)? Are you interested in receiving affordable financing for your grant match requirement? Our READI Match Financing (RMF) Program is designed to offer financing through our Community Funding Resource Program framework, which offers direct financing for public projects with terms of up to 10 years.

Click here for an overview of the Program.

Click on the link below to request an application or ask a question.

Hoosier Equipment Lease Purchase Program

Simply and quickly access competitive essential equipment financing through the Hoosier Equipment Lease Purchase (HELP) program. Financing through HELP satisfies Indiana's legal requirement to bid the financing, while using a simple 1-page application to connect you to the most competitive rates offered through the IBB’s statewide network of lenders. Our new HELP “Rate Buy-Down Enhancement” now offers the opportunity for even greater savings.

Advance Funding Program

Sometimes things don't go as planned. Through no fault of your own, you have a timing mismatch between expenses being due and your property tax disbursement. Through the Advance Funding Program, the Indiana Bond Bank offers cash flow stability to units of government through pooled tax anticipation warrants at an all-inclusive competitive rate. Since 1984, the Advance Funding Program has assisted over 250 units of government with $14 Billion in short-term cash flow needs.

Interim Loan Program

The Interim Loan Program offers short-term design study and construction cost financing for USDA-Rural Development projects. The process is streamlined through established partnerships and experiences. The program is currently structured to serve design study and construction cost financing needs of municipalities already approved for USDA-RD permanent financing. If you are in need of design study or construction cost financing, but not approved for a USDA-RD loan, please use the "Ask Us a Question" button below to see how we might assist!

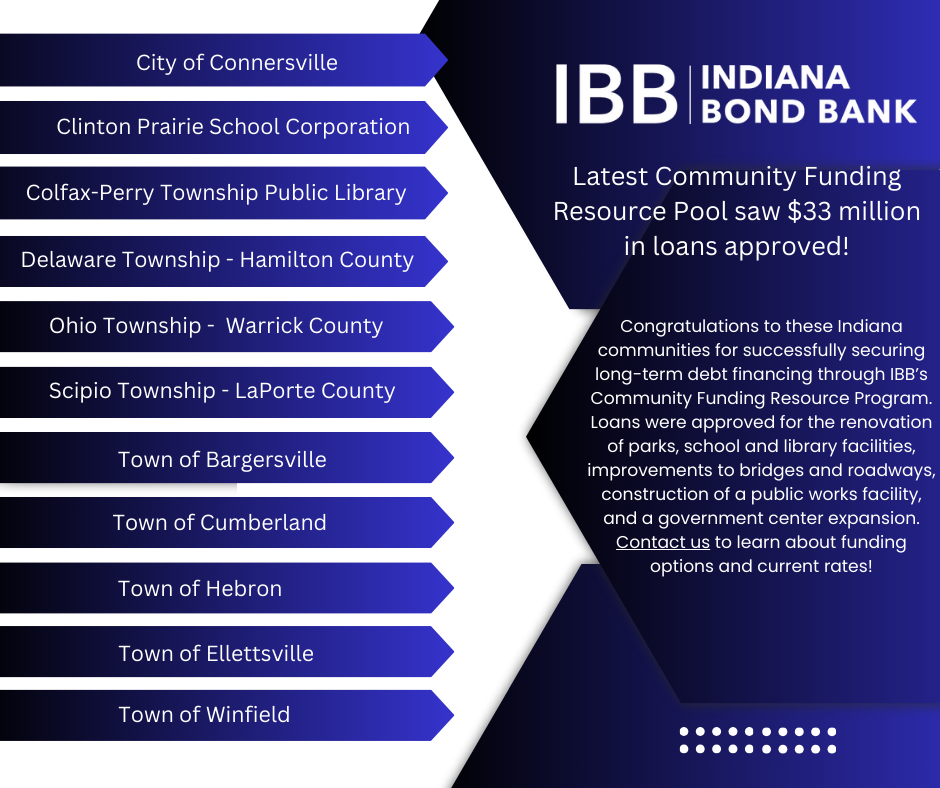

Community Funding Resource Program

Starting a new public project? Thrown off course trying to locate efficient and affordable financing? Need hands-on assistance from experienced professionals? Let the Community Funding Resource (CFR) program get your project headed in the right direction. Through our CFR program, the Indiana Bond Bank offers direct financing for any public projects with a term of up to 25 years. We accept applications on a rolling basis, so tell us a bit more about your project below and we can let you know how the IBB can help!