Targeted Financial Solutions for Local Government

We finance the essential needs of Indiana local government through targeted programs. We envision thriving local institutions, thriving communities, and thriving Hoosiers.

Benefits

Why finance with Indiana Bond Bank?

Here are 3 reasons to chose IBB for your next project...

Committed

Our team is here for you, to walk you through each step of your IBB financial solution. We know you have a lot on your plate – and you’re probably not issuing debt on a regular basis. Let our team help you.

Trusted

Trusted – We’ve served as the State of Indiana’s lender for local government since 1984. With 40 years of experience, we’ve been trusted to handle almost $23 billion in debt issuance.

Efficient

We work to put you in the right solution to fit your financial needs. Need a simple equipment lease? Our built-in network of Statewide lenders will provide you access to competitive rates. Need long-term financing but aren't sure about the capital markets? We have capital to lend directly to you, without the cost of public issuance.

Services

How we can help

Hoosier Equipment Lease Purchase Program

Equipment Financing

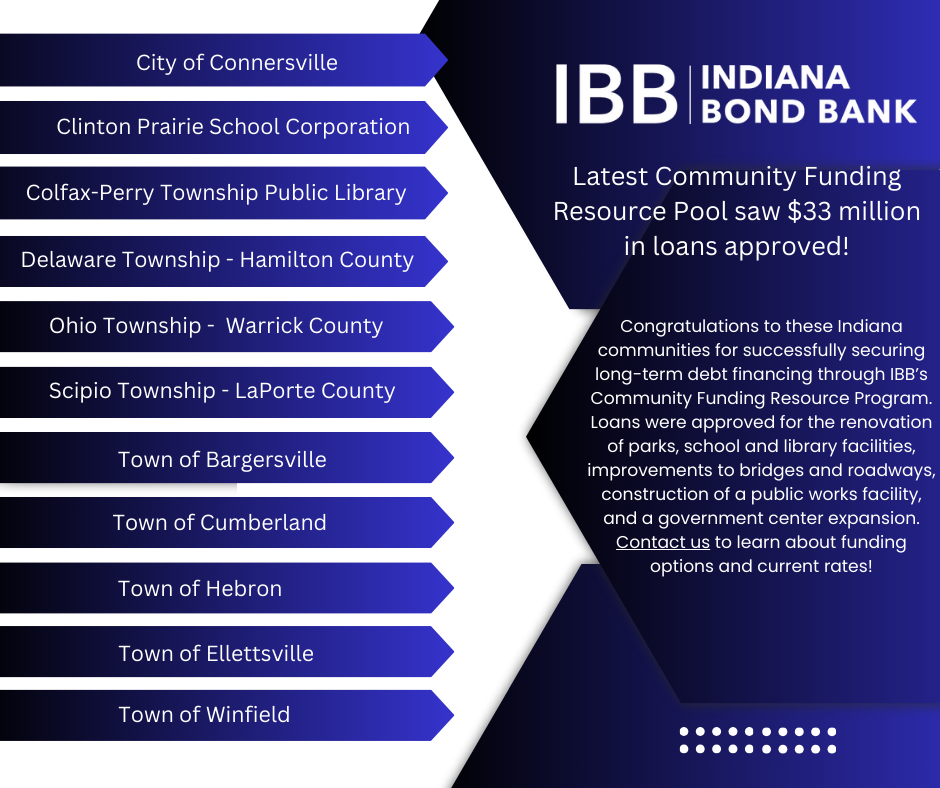

Community Funding Resource Program

Public Project Financing

Advance Funding Program

Cash Flow Financing

Fuel Budgeting Program

Budget Risk Management

Interim Loan Program

Construction Cost Financing & Design Study

READI Match Financing Program

Investing in Growth and Prosperity of Individuals and Families that call the Hoosier State home.

Events

A look at our calendar

Here’s what's coming up from meetings to important program dates and more.

Want the inside scoop?

Sign up for our newsletter and get all the latest insights on funding programs.

Ready to get started?